Established in 1969, Gap Inc. is a leading American clothing retailer that operates several prominent brands, including Old Navy, Gap, Banana Republic, and Athleta, catering to diverse consumer segments.

The following analysis is based on Gap Inc.’s publicly released factory list. Only factories identified as producing “apparel” products were included in the analysis.

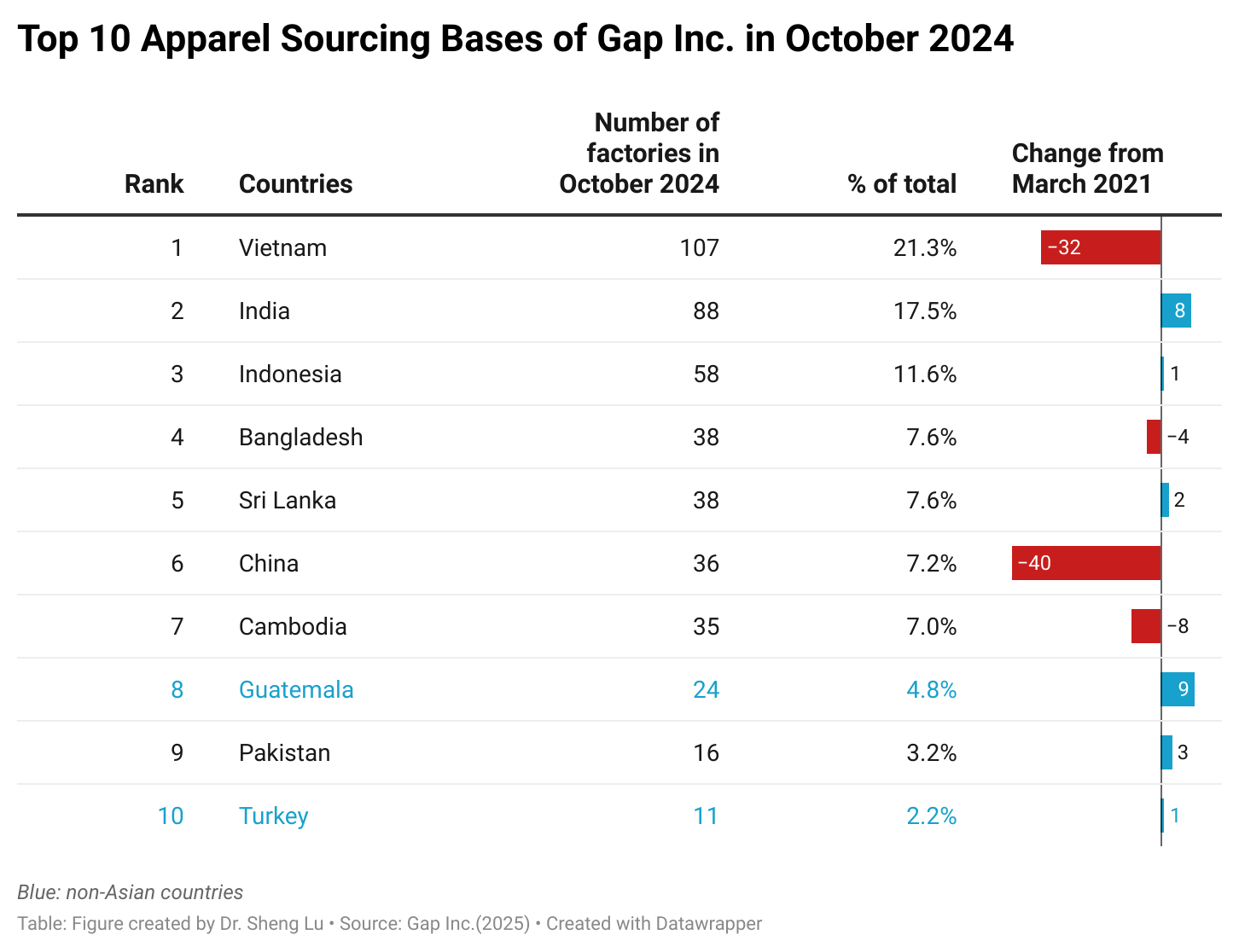

First, like several other leading U.S. fashion companies, Gap Inc. maintained a geographically diverse global sourcing base but reduced the number of factories it sourced from between 2021 and 2024. Specifically, as of October 2024 (the latest data available), Gap Inc. sourced apparel from 24 countries, an increase from 21 countries as of March 2021. Gap Inc.’s apparel sourcing reached almost all continents, including Asia, the Americas, Europe, and Africa.

However, between March 2021 and October 2024, Gap Inc. decreased the number of apparel factories it contracts with from 548 to 502, a reduction of 46. Most of the cuts occurred in China (down 40 factories), Vietnam (down 32 factories), and Cambodia (down 8 factories). This pattern aligned with the findings of other industry studies, which indicate that many U.S. fashion companies, particularly larger ones, are consolidating their vendor base to prioritize operational efficiency and strengthen the relationships with key vendors.

Second, Gap Inc. has significantly reduced its reliance on China and actively explored emerging sourcing destinations in the rest of Asia, Central America and beyond. According to Gap Inc.’s 2023 annual report (the latest available at the time of writing), its two largest vendors represented approximately 9 percent and 7 percent of the total dollar amount of the company’s purchases. In value terms, in 2023, approximately 29 percent of Gap Inc.’s products were sourced from Vietnam, followed by Indonesia (18 percent).

While China remained the largest source of U.S. apparel imports according to official trade statistics, China now plays a relatively minor role in supplying finished garments for Gap Inc. As of October 2024, the company sourced apparel from 36 factories in China, representing just 7.2 percent of its total apparel sourcing base, making China only the sixth-largest supplier after Vietnam, India, Indonesia, Bangladesh, and Sri Lanka. In an interview conducted in early 2025 (the video above), Gap Inc.’s CEO disclosed that less than 10 percent of the company’s products are sourced from China.

On the other hand, between March 2021 and October 2024, Gap Inc. expanded its sourcing network beyond the traditional top three (China, Vietnam, and Bangladesh), with significant growth in other parts of Asia and Central America, led by India (added 8 more factories) and Guatemala (added 9 more factories). In 2022, Gap Inc. pledged to source around $150 million in apparel products each year from Central America by 2025.

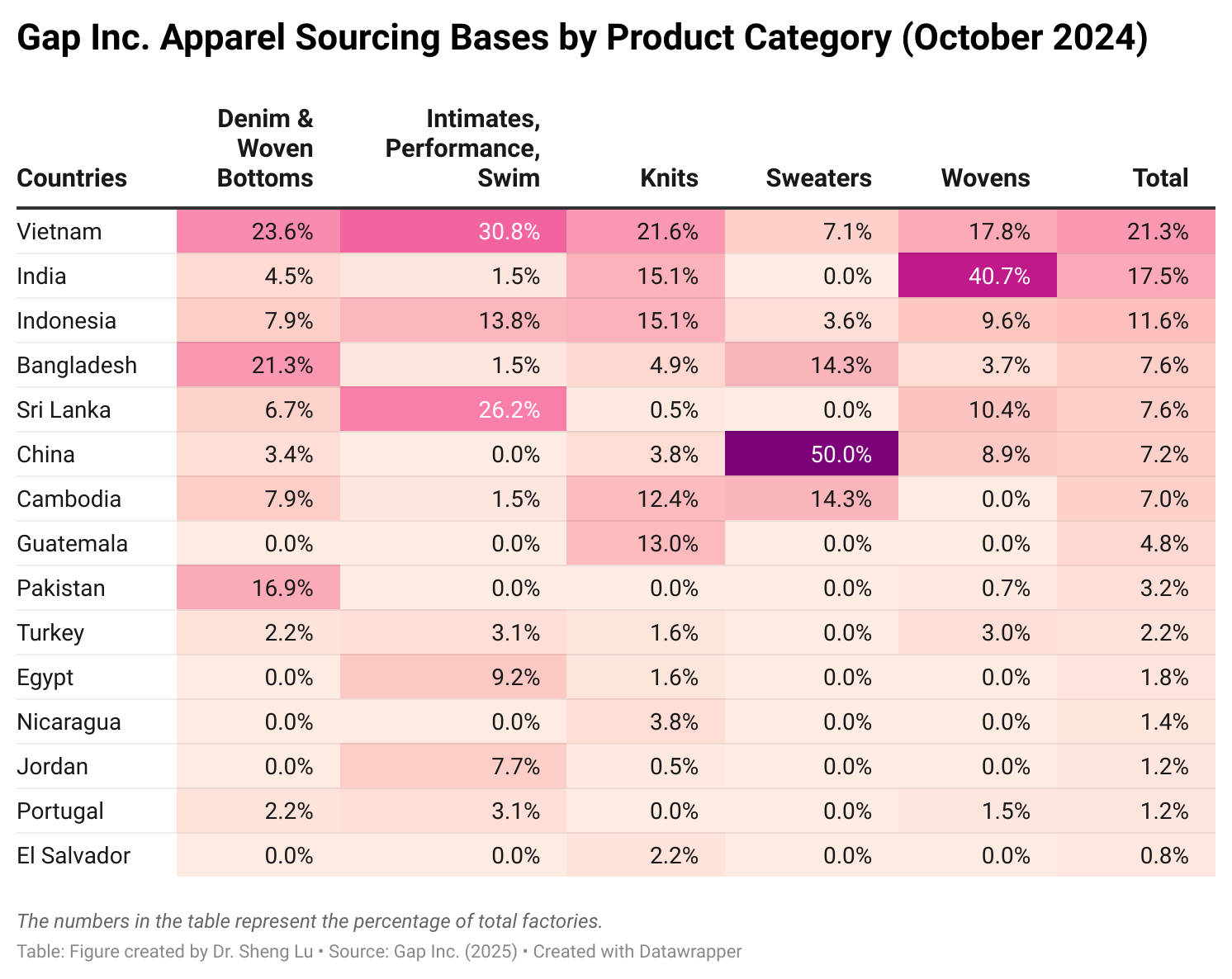

Third, Gap Inc.’s apparel sourcing base varies by product category. For example, approximately 45% of the company’s contract factories producing denim and woven bottoms were located in Vietnam and Bangladesh, likely due to the availability of cotton and a relatively abundant low-cost labor force. In contrast, factories in Sri Lanka primarily manufactured intimates, performance wear, and swimwear (IPSS) for Gap Inc. Meanwhile, half of the company’s sweater factories were located in China, largely due to the complex manufacturing process and raw material requirements for these products. Additionally, India played a critical role as a sourcing base for Gap Inc.’s woven apparel.

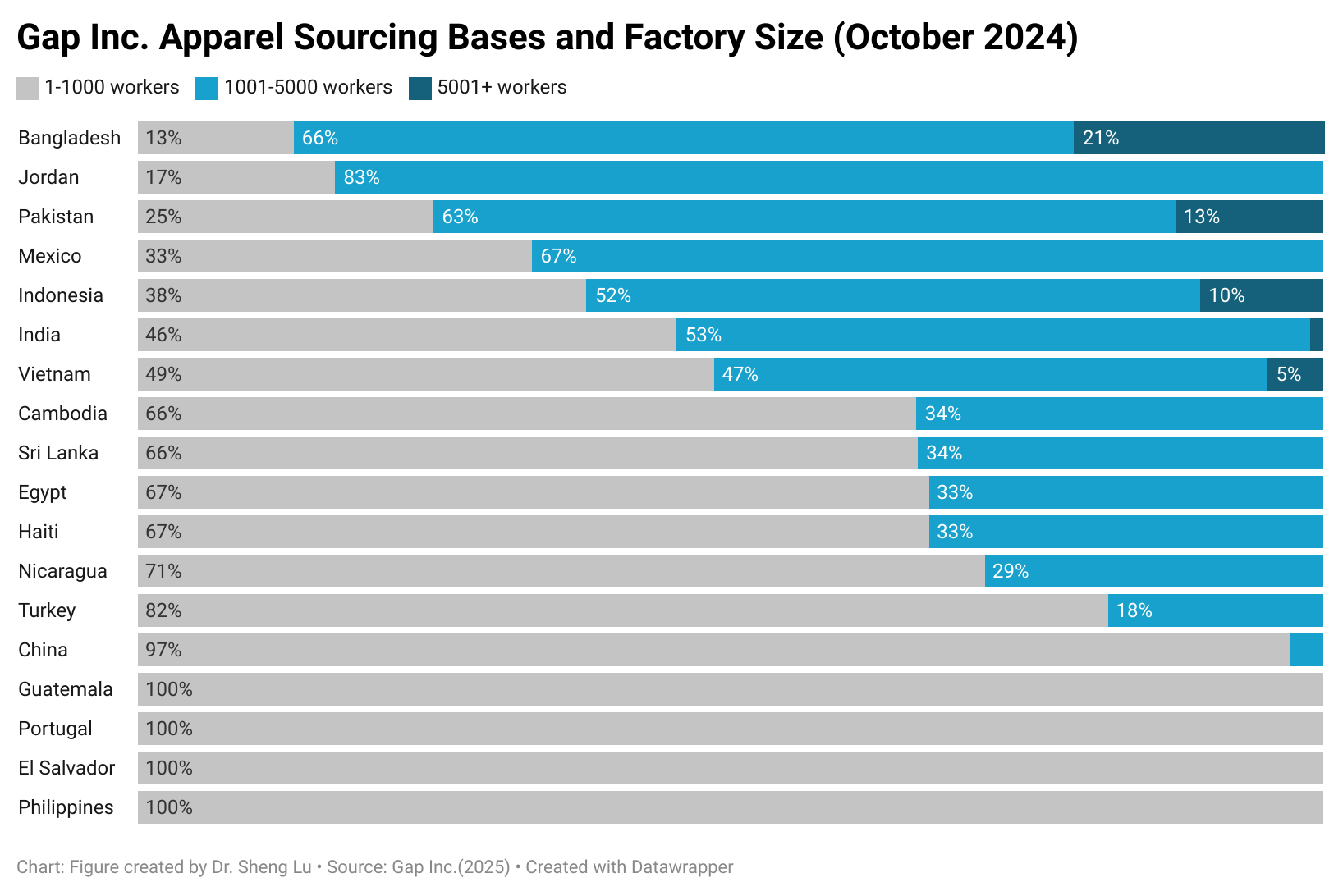

Furthermore, Gap Inc.’s contract garment factories worldwide vary in size, reflecting the company’s diverse sourcing needs. Specifically, in Asia, garment factories in China are typically small or medium-sized, with fewer than 1,000 workers (94.3%). In contrast, nearly 80% of Gap Inc.’s contract garment factories in Bangladesh have more than 1,000 workers, with similar patterns observed in Vietnam (48.7%), India (50%), Indonesia (63.2%), and Pakistan (57.1%). This pattern aligns with other industry studies suggesting that U.S. fashion companies source apparel products from China primarily for orders with relatively small minimum order quantities (MOQs) and those requiring a great variety.

Meanwhile, most garment factories in Central American countries producing products for Gap Inc. have fewer than 1,000 workers, such as Guatemala (100%), Nicaragua (71%), Haiti (67%), and El Salvador (100%). A similar pattern is observed in other regions, such as Egypt (67%) and Turkey (82%). This result suggests that Gap Inc. may still need to rely on Asia to fulfill orders for large-volume items, as it takes time to expand production capacity in other regions.

by Sheng Lu